While having a reasonable timeline for Return on Investment (ROI) is necessary to get organizational buy-in, excessive focus on immediate return on investment (ROI) can make your AI strategy dangerously short-sighted. Companies too often chase immediate cost savings or quick wins from AI, at the expense of long-term innovation and value creation. This narrow approach not only limits AI’s transformational potential in general business applications, but is especially risky in customer support and experience.

The Main Limitation of AI-Driven Cost Cutting

The primary use case we see for AI is cost reduction – whether by automating manual tasks to reduce labor costs or replacing human labor entirely, with something like an AI Agent. And while this is an easy place to get started with AI, mainly due to the clear ROI, cost reduction has a hard floor while value creation has no ceiling. There is a defined limit to how much you can save (costs cannot go below zero), yet there is virtually no cap on new value or revenue AI can generate through innovation.

In fact, over-reliance on AI for staff reduction or expense cuts not only hits a point of diminishing returns, but can also erode quality, service, and morale if taken too far. In the context of AI, this rings especially true. A pure cost-focus is short-sighted: it might improve this quarter’s margins, but it won’t fuel transformative growth.

But organizations struggle with giving up these short-term gains even if it means ignoring longer term income-generating AI use cases. It takes both vision and discipline to see the potential for “transformative developments” rather than just chasing “cheap” AI projects for quick savings.

Short-Term Thinking in Customer Support: A Cautionary Tale

We’ve already seen the impact of short-term ROI obsession in customer support and experience. Many companies rushed to roll out chatbots, IVRs (interactive voice response systems), and self-service AI with the primary goal of reducing call volumes or headcount. On paper, the ROI seems straightforward– fewer live agents mean lower operating expenses. But the long-term cost of that frustration can far outweigh the savings. When AI is used merely as a barricade to deflect customers for short-term savings, it often degrades service quality and frustrates customers.

For example, FedEx – once known for outstanding human customer service – introduced an AI phone bot that made it nearly impossible for customers to reach a human representative. In a published case study, a loyal FedEx customer recounts how the rigid bot refused to hand off to a person, even hanging up on him repeatedly; the experience was so bad that he vowed “now I hate FedEx and will avoid paying them anything, for life.”

Does saving a few cents today justify losing a customer for life? Most business leaders would say no, but still these decisions are made without considering customer loyalty or lifetime value.

Forecasting Your AI-to-Human Agent Ratio

Understand where you should apply AI agents – and where human agents work best – to maximize your AI investment without sacrificing customer experience quality.

The Trap of Short-Term ROI Focus

Many businesses still evaluate AI initiatives solely on immediate cost reduction or fast revenue gains. This “efficiency myopia” fails to capture AI’s full strategic impact. And since AI initiatives are relatively nascent, focusing only on what can deliver immediate value may lead to missed opportunities in the future. Asking companies to prioritize long-term AI strategy over short-term ROI is easier said than done in the current AI hype cycle. But it’s a necessary perspective that will create lasting value and prevent painful – and potentially public reversals.

Focusing only on near-term metrics can lead to “short-sighted investment decisions” and missed opportunities for innovation. One cautionary statistic: a recent survey showed 75% of companies aren’t yet seeing ROI from AI, often because they apply the tech only to low-impact, low-risk tasks and expect instant results. Many of those firms now plan to scale back AI investment – potentially a costly mistake if it causes them to fall behind more patient competitors. The lesson is clear: AI is a long game. Short-term payoffs are possible in pockets, but the real competitive edge comes from sustained, cumulative AI gains that manifest over multiple years.

In short, treating AI like a quick fix for next quarter’s numbers is a strategic mistake. It’s a “sugar high” that leads to immediate returns, but little lasting effect. It may deliver a small bump in efficiency, but it blinds the organization to AI’s far greater cumulative benefits over time.

🔥 Hot Take 🔥

Stakeholder focus on ROI actually makes their AI strategy short sighted because immediate ROI benefits are always cost reduction tasks (cost reduction goals can be achieved predominantly through automation). While reducing costs is a worthy cause, (it is limited), creating value has no bound. By enhancing, and creating – you are enabling new capabilities. Instead of reducing – we must be enhancing and augmenting. AI can generate exponential growth that traditional ROI models fail to capture. Cost-cutting has a floor – you can’t reduce costs below zero – (for now you can’t reduce head count to 0), but value creation has no ceiling.

Organizations that are fixated on short-term ROI metrics often miss AI’s transformative potential to create entirely new business models, unlock previously inaccessible markets, and deliver unprecedented customer insights. These opportunities may require longer investment horizons and different success metrics that extend beyond quarterly balance sheets.

Long-Term Vision: Success Stories and Missed Opportunities

Companies that play the long game when it comes to AI, in a way that complements their vision and strategy, often build durable advantages, while those fixated on short-term returns can miss the boat. Successful adopters typically treat AI as a strategic investment in future capabilities, even if the early ROI is modest.

McKinsey’s global AI survey found that the most AI-mature enterprises – those that integrated AI deeply over years – attribute over 10% of their annual EBIT (earnings before interest and taxes) growth to AI efforts, far outpacing competitors. But there’s also even more firms that have piloted promising AI projects only to abandon them if they didn’t pay off within a single budget cycle. Such timidity can mean forfeiting the next big breakthrough. A Board of Innovation report calls out “failing to connect [AI] use cases for systemic returns” as one of the biggest missed opportunities in AI strategy.

In other words, companies that treat AI projects in isolation, judging each by immediate ROI, may never achieve the compounding “contagious ROI” that comes from scaling AI across the enterprise.

AI as a Catalyst for Exponential Growth and Innovation

Properly harnessed, AI is far more than a cost-cutting tool or a short-term boost. It’s a catalyst for growth, innovation, and new business models. Traditional ROI models, however, often struggle to capture these forward-looking benefits. AI initiatives may start with modest returns, but they can scale exponentially once algorithms learn and platforms mature.

For example, AI-driven insights can lead to entirely new revenue streams or even industries. Think of how recommendation algorithms unlocked ecommerce upselling and streaming personalization: Amazon’s AI-powered recommendation engine generates 35% of the company’s revenue by suggesting products shoppers didn’t even know they wanted.

These gains accrued over years as data network effects kicked in and customer lifetime value grew. But the greater potential might be that AI can enable entirely new business models – from predictive maintenance services in manufacturing to personalized digital assistants in retail – that simply did not exist before. These opportunities defy simple short-term ROI equations, since their payoff is strategic and long-range.

Organizations stuck in the idea of using AI to cut costs will likely plateau, whereas those who invest for the long term can achieve game-changing, exponential growth.

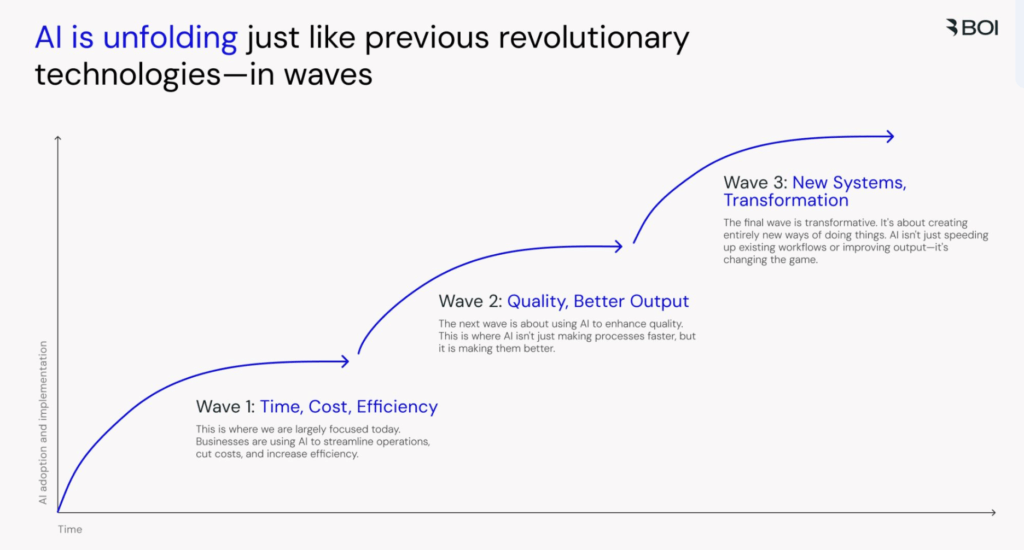

AI adoption unfolds in waves: many firms focus on Wave 1 (short-term efficiency gains), but the biggest value lies in Wave 3 – using AI for new systems and transformative business models. Short-term wins are just the beginning; long-term vision is needed to “change the game.” (Board of Innovation, “Calculating the ROI of AI strategy”, March 12, 2025, https://www.boardofinnovation.com/blog/calculating-the-roi-of-ai-strategy)

Measuring What Matters: Beyond Quarterly ROI Metrics

If traditional ROI is too narrow a lens for AI, how should organizations measure success? One approach is to evaluate Return on Transformation Investment (RTI), as advocated by Constellation Research. RTI looks at an AI or digital initiative holistically over a five-year horizon, weighing not just costs and benefits but also the probability of success and strategic value of the project type.

This kind of long-term metric forces leadership to consider whether an AI initiative will “improve the value of the enterprise within three years” rather than whether it pays back in six months.

In practice, companies are also tracking qualitative and leading indicators of AI success. For example, improvements in customer experience metrics – like customer satisfaction ratings, average handle time, or retention rates – are critical signs that AI is delivering value, even if the immediate revenue impact isn’t obvious or overwhelming.

Customer lifetime value (CLV) is another powerful metric: if AI-powered personalization or support increases the average CLV of your customer base, that will translate into significant future cash flows that a quarterly P&L won’t yet reflect. Some firms even establish an “AI readiness” or capability index, measuring how well the organization has incorporated AI into its processes and culture (viewing that as an asset that will pay off in agility and innovation).

By broadening success criteria, they avoid killing promising AI initiatives prematurely. In essence, new metrics encourage a longer-term mindset: they remind stakeholders that AI’s biggest wins – in customer loyalty, innovation, and market position – develop over multiple periods, not within one quarter.

Conclusion

AI is not just another IT cost to minimize; it is a transformative capability that, if nurtured correctly, can drive nonlinear growth and reinvent business models. Firms that judge AI projects only by immediate ROI often automate the obvious and stop there – saving a few dollars but leaving massive value on the table. Or they automate tasks that would be eliminated entirely by rethinking business goals and strategy.

Those that take the long view, by contrast, invest through early growing pains, integrate AI deeply into their products and decisions, and end up leapfrogging competitors. The evidence is clear: short-term AI thinking leads to incremental gains at best (and at worst, customer alienation and strategic stagnation), whereas long-term AI investment yields compounding returns that traditional ROI models fail to imagine. As one report succinctly put it, “AI investment should not be short-sighted” – its true power is in building adaptive, intelligent capabilities that ensure resilience and relevance for years to come.

To succeed with AI, business leaders must resist the tyranny of quarterly results and reorient toward sustainable value creation. That means measuring what matters – customer outcomes, innovation, competitive advantage – and giving AI initiatives the runway to achieve them. Companies that adopt this philosophy are already seeing AI drive double-digit improvements in efficiency, customer satisfaction, and new revenue. In the long run, these are the gains that differentiate industry leaders from laggards. AI is a marathon, not a sprint – and the finish line is well beyond the next quarter’s ROI report.